The world of medicinal cannabis and the next 5-10 years of development in the UK is far from simple. A lot of the challenges in the UK are also relevant to other geographies where perscription cannabis is legal.

I believe that the most interesting areas for innovation are:

* Removing friction in prescribing. This includes clinician education within a “school of medicine”.

* Increasing consistency in cultivation and providing patients with quality consistent supply.

* Managing the supply chain. This includes quality assurance, supply chain traceability and compliance management. Transparent labelling and full COA provided with all perscription’s dispensed.

* The role of private clinics specialising in cannabis prescribing. Will the NHS look to refer patients out to private specialists or will demand for these clinics crumble when the data is such that NHS clinicians can confidently prescribe at scale?

The main questions and trends that I am paying most attention to are:

* Level of comfort for UK clinicians to prescribe and what they need to see to get as comfortable as their German counterparts.

* The opportunity for internationalisation of success businesses overseas into more nascent markets, or whether more nervous regulators will look for local solutions

Today’s landscape

The NHS is only writing 1-2 prescriptions a month, while Germany is showing us how it’s done when the evidence, regulation, and clinicians pull in the same direction.

Prior to 2017 the regulations in Germany were much the same as in the UK or other European countries, but since a review which meant that doctors could prescribe medicinal cannabis, subject to some requirements being met, and insurers being supportive, Germany now represents over 70% of European cannabis sales with approximately €170m of sales in 2019, albeit having any accurate view on this number is challenging. In December 2019 alone, German health insurers paid out €13m to cover the cost of medical cannabis products, with approximately 50% of that being for unprocessed flowers. For context, there are two main categories of medical products derived from products; authorised and licenced finished drugs (comparable to Aspirin) and Cannabis preparations which include unprocessed flowers and extracts.

Taking data from the Canadian medicinal cannabis market with a population of 37 million people and with approximately 330k registered medicinal cannabis patients (1% of the population) would give an average cost per patient of £881.

Transposing the same proportions and pricing to the UK would give a £500m medicinal cannabis market and £650m in Germany; in many ways Germany may just be at the start of this trend! Many market commentators would also say this is a conservative view and the more likely market size may be more like 3x this level in the next 5 years.

The UK numbers are perhaps a more complex story. In November 2018 Cannabis was re-scheduled as a substance from Schedule 1 (alongside Ecstasy and raw Opium) to Schedule 2 (alongside peers such as Cocaine, amphetamine and methadone). This was the result of my little boy ,Billy who in June 2018 had his life saving perscription cannabis confiscated at London Heathrow after his NHS GP was informed to seize prescribing. Within days Billy suffered a pro- longed seizure and was hospitalised resulting in his medicine being returned which changed the UK cannabis law. Billy was issued with the first ever license to use medical cannabis and accessed the first ever NHS funded cannabis perscription.

Whilst this was seen as a turning point, in that after the re-scheduling doctors could prescribe medical cannabis as an unlicensed “special” treatment if all other options had been exhausted, this in effect did very little to the level of NHS prescriptions.

Looking at data from early 2020, only approximately 25 prescriptions per month were being issued in the UK and with only 1-2 per month through the NHS. Compared to the Canadian benchmark of 1% of the population getting clinical benefit from medicinal cannabis, the UK prescription number represents 0.005% of those who could benefit (i.e. 550k potential patients). To put this in context, this is the same as the whole of the UK population being eligible to benefit from a treatment but only Asda employees receiving it – this is what 0.005% of an eligible population looks like!

The potential in the UK when regulation, clinicians and data pull in the same direction is immense and sadly those that will benefit most are those in really challenging medical situations e.g. chronic pain, cancer patients, substance addictions, MS or epilepsy.

Lack of quality data!

One of the main reasons for lack of NHS support in prescribing cannabis is the lack of quality data which has left me disheartened and somewhat astonished with the lack of uptake within industry.

Quality of sample data;

Equally, in the latest guidance from NICE around the prescription of medicinal cannabis it is also very consistent in its view of low quality of sample data for virtually every application of medicinal cannabis outside the use of Sativex , Naboline and Epidiolex, the only licensed pharmaceutical cannabis derived drugs in the UK currently.

This desire for more robust data set led to one ambitious project , set up in 2021 , with the enrolment process reassuring patients their data would support NHS perscription’s. Three years on it’s quite evident this study is not fit for purpose and has not managed to take the blocker of the table.

Regulated value chain;

The value chain for a highly regulated substance like Cannabis, with additional political interest, is a complex and expensive one which also hampers rapid adoption. Having supported hundreds of patients starting and through the process to access a prescription for medicinal cannabis privately to help with various conditions, I can vouch that the current process and financial cost to patients presents huge challenges . There are approx 38 private clinics in the UK with prescribing licenses for medicinal cannabis but with under 100 new prescriptions a month in aggregate it is hard to see how the maths currently works for this to be a sustainable business for these dedicated clinics ?

For initial consultation this involves anything between £99.00 /£200.00 up-front fee with the expectation that the prescription would likely be approx £150/200 a month. This is clearly not cheap but when you think that in order for patients to get a prescription, they need to have an initial consultation, the physician needs to be confident that the patient has exhausted all other available routes after requesting and reviewing the patient’s medical history, and then an MDT , which if successful a perscription is written and sent to a pharmacy. Now the challenge is , if the patient pays the pharmacy via online payment link – is the perscribed medicine in stock ??

This is a complex process which of course has both financial and mental health costs attached to it. Patients for whom perscription cannabis may be appropriate have the option of finding a NHS clinician who will prescribe an unlicensed drug (good luck!) or pay-up and pursue the private route where the openness to prescribe is much higher. Coupled, that without considerable change in the regulatory requirements around perscription cannabis it is hard to see how the costs and process for patients will meaningfully change when it comes to prescribing unlicensed cannabis products as a treatment in the near future.

The Future

I have had the privilege of having some fantastic conversations with clinicians, scientists, entrepreneurs, economists and patients on the topic of perscription cannabis and the more I dig into this topic the more I am convinced that there will be many UK medical businesses that will be built out of the growing acceptance of the clinical value of cannabis in its many forms. This is a topic where the stake holders, incentives and interests are complex and range from IP protection, supply chain robustness and quality of clinical studies.

Research! Research! Research! Industry must step up.

After policy makers, it feels like the most powerful stakeholders at the end of the day are clinicians and giving them all the tools they need to prescribe medicinal cannabis at scale.

Conclusion

My forecast on this topic is that when prescribing cannabis can look like prescribing any other medication and there are no special additional checklists for doctors to complete then it will be widely prescribed.

I also agree that pharmaceutical cannabis products, much like those produced by GW Pharma or smaller challenger therapeutics developers, will be the future of how patients will unlock the value from prescription cannabis but until “fit for purpose” data and studies have been completed, the world of NHS funded prescription cannabis will remain a hype.

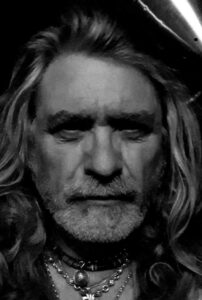

Charlotte Caldwell